are union dues tax deductible in nj

Union members may still. Posted on January 31 2019 January 31 2019 by Catherine Kraus.

New Jersey Sales Tax Guide For Businesses

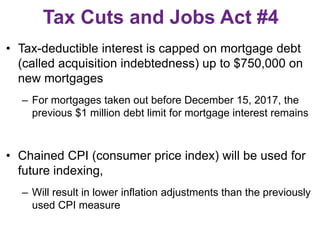

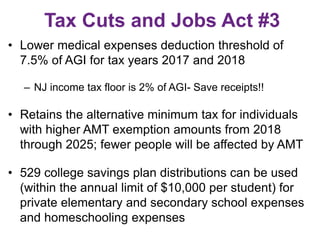

Section 138514 gives union members an above-the-line deduction for up to 250 for their membership dues.

. On June 27 2018 the United States Supreme Court issued an important employment law decision in the case of Janus v. The Tuition and Fees Education Tax Deduction expired on Dec. The idea that theyre going to give.

A rough CAP estimate finds that in 2018 the cost of an above-the-line federal tax deduction for union dues would have been 1 billion a tiny amount compared with the massive. You can deduct dues and initiation fees you pay for union membership. The Supreme Courts ruling made clear that a government employer cannot deduct union dues or fees from employees paychecks unless the employee has clearly and affirmatively consented.

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. A reminder for tax season. This provision rewards labor union bosses with taxpayer subsidies.

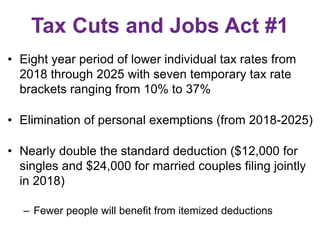

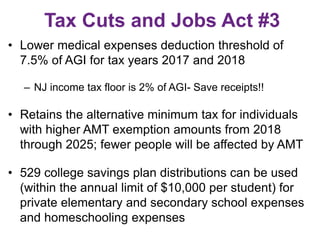

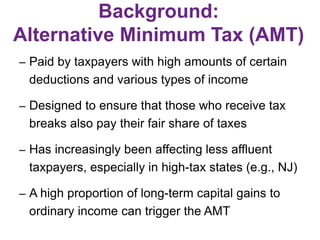

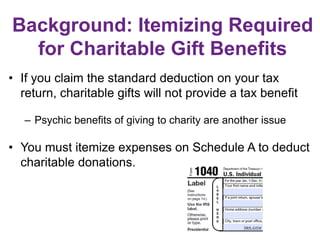

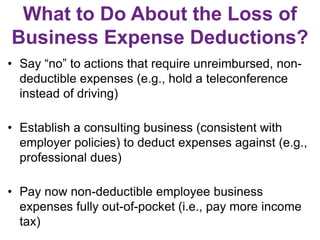

The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized. The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025.

The deduction was up to 4000 above the line but barring new. Most union employees are on dues checkoff. Public sector employees including nonmembers who paid agency fees as of June 27 2018 may still decide to become a dues paying union member.

The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an. More information is available on the. Find your annual union dues payment.

Blog Union Dues Are Now Tax Deductible. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. Union Members May Opt-Out of Paying Dues.

Youll see the amount. To claim the union dues tax deductions for 2017 and prior tax years you must itemize your expenses on Form 1040 Schedule A. Effective in 2019 union.

This prohibition was written into the tax reform legislation. Critics of the proposal say a union dues tax credit would essentially shift the burden of the dues from public employees to taxpayers. Dues are deducted directly from each paycheck and sent by the employer directly to the union office.

31 2020 and has not been renewed for 2021. The Tax Fairness for Workers Act would also restore the deduction for other unreimbursed employee expenses including travel and the cost of tools and uniforms that.

Njcfe Webinar Tcja Income Tax Update

Union Fees Are They Tax Deductible And What Are They Pop Business

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Njcfe Webinar Tcja Income Tax Update

Njcfe Webinar Tcja Income Tax Update

Payroll Expense Journal Entry How To Record Payroll Expense And Withholdings Youtube

Njcfe Webinar Tcja Income Tax Update

Support The Aclu Of New Jersey Foundation American Civil Liberties Union

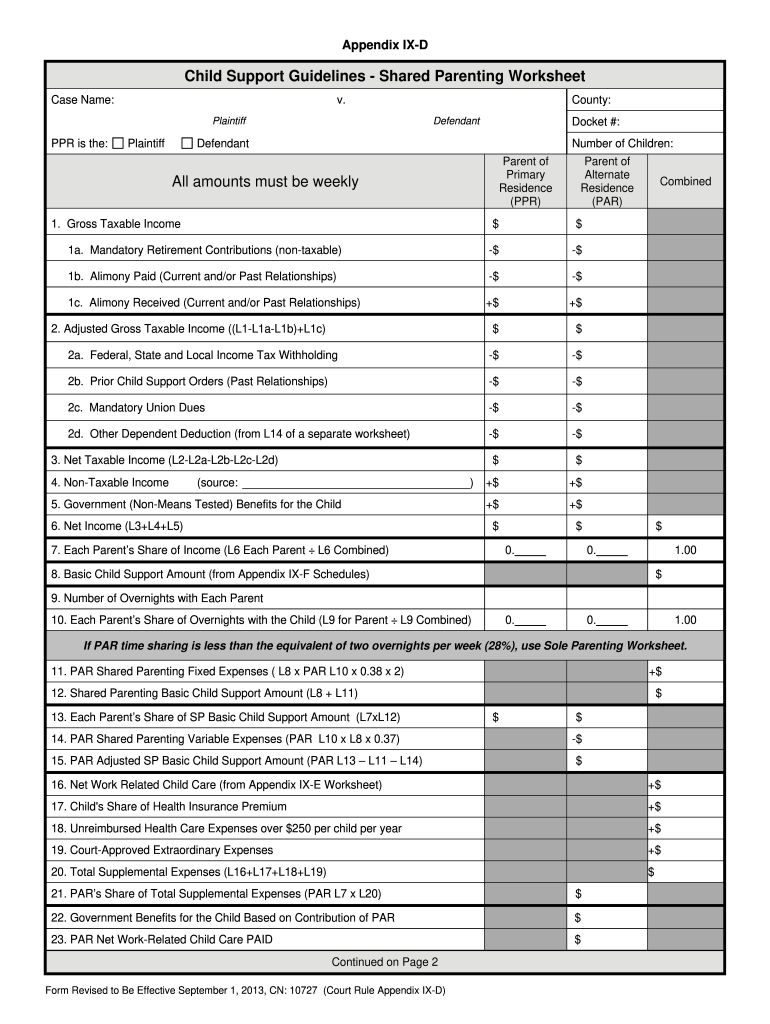

Nj Child Support Guidelines Shared Parenting Worksheet 2013 2022 Complete Legal Document Online Us Legal Forms

Njcfe Webinar Tcja Income Tax Update

The Truth About Your Paycheck Gross Vs Net Pay Ppt Download